I read, think and write about personal finance quite a bit, just like you probably do. I talk about it a lot too, including dispensing advice from time to time.

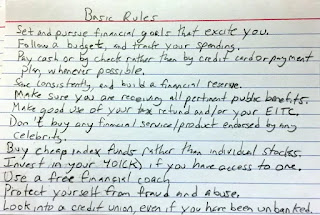

When it boils down to it, the many facets of personal finance can fit on an index card including the most famous one by Harold Pollack. I have one of my own.

|

| Harold Pollack's famous index card of financial advice. |

|

| The Money Mensch's financial index card rule #1 is to Pay Yourself First |

This would consist of a pension of $4,480 per month from IMRF plus $2,280 per month from Cook County, where I toiled for nine years as an Adult Probation officer (seven years) and economic development planner.

Yes, it is a good amount, but there are a lot of buts involved.

First and foremost, this formula assumes that I will continue in a position that pays what I earn right now plus a three percent raise per year. As it goes these days, we have not received three percent raises for the past several years. Also, as everyone knows, there is no guarantee of continued employment for a period of seven years. I hope to remain gainfully employed at my current salary or higher through 2025, but in life there are no guarantees.

Second of all, my wife works extremely part-time and only makes about $7,500 per year, so whatever retirement income I receive has to be enough to support two people. We will both be eligible for social security way off in the future, but I fully intend to cease working for local government well before I am eligible for social security as it exists in the early thirties.

Third, we reside in a highly taxed state. Should we continue to reside in the Land of Lincoln in our so called "retirement" years, we could be paying $8,000 or $10,000 or more in property taxes for the privilege of living in a corrupt state with horrible weather for about a third of the year. We also live in the suburbs of a City where you could be shot dead at any given time if you stray out of the third of the City where it is safe to be.

Next, we have no way of knowing what type of healthcare costs we will incur in the future. Our son has unfortunately been hospitalized on several occasions which would have bankrupted us had we not had decent health insurance.

With a few ailments that I have now at the Prime Age of forty-seven, it is safe to assume that both my wife's and my healthcare costs will not go down in the coming years. My father-in-law pays over two grand per month for health insurance for himself and his wife and shells out about another two grand per month for his medications. He does not have a pension (he does have an annuity that he purchased) like I will have and has operated his own business for the past thirty years or so.

Finally, there is always the element of the unexpected. I wonder if the many adherents to #FIRE take their future healthcare costs and the many unexpected costs that arise into consideration. Even if I saved a cool million bucks by the age of thirty-five, I would not consider retiring.

I do know a guy, a friend of a friend, who retired shortly after the age of forty after having saved up two mil. However, he and his wife are childless and he has since dabbled in investing with a new group of traders. An SEC indictment helped make him decide to "retire" for a few years.

For the rest of us, guys like me who grind away at working, saving, paying for college, generating "passive income" and dreaming of "retirement," I would have no way to save up a million or two and I am much closer to fifty years old than forty.

Which finally brings me to my point.

When it comes to retirement and caring for yourself and loved ones in your "retirement" years, it is a YO-YO economy. You Are On Your Own.

Thus, even though for quite a few years I saved everything that I could for my children's college educations, which comes in handy now that I pay about three grand per month for our son's, I did so at the detriment of my own retirement savings. I figured that my wife and I would simply live off of my pension.

The closer that we get to 2026 and the more expensive things continue to get, I realize that $70,000 per year may not prove sufficient to support us in a lifestyle that we wish to live. Sure, we could continue living in a modest house, could possibly afford decent healthcare, purchase some groceries and maybe even eat out once in a while.

But it sure would not allow us to travel to visit our children and potential future grandchildren.

It would not allow us to rent a nice house in a warm climate for a month at a time during the winter if we so choose to, like my wealthy aunt and uncle do.

It would not allow us to travel to Europe or even Disney World like we have many times.

I am a Jewish man and strive to be a mensch, as my blogging nom de plume implies, thus I would like to be able to hand out twenties or perhaps fifties to my progeny as the years go by like my own predecessors did.

The lifestyle that I hope to live in my mid-fifties and beyond would most definitely require more than a $70,000 income.

Paid Myself First

So I Paid Myself First three times in August. To be precise, I paid myself each of the three paydays that we had - once on the third, once on the seventeenth, and yesterday on the final day of the month.

Because I had been reading so many posts and articles about saving better this past month, I decided to act upon it rather than just read or write about it.

Although I have put the practice of Paying Myself First into action the past three or so years on every payday, I added an extra hundred bucks to my payment twice. Thus, I paid myself $800 in August, $200 on the first payday and $300 on both the second and third paydays of the month. Obviously, I want that money to grow into significantly more over the years, perhaps to twice as much, which would help defray some healthcare costs that my wife or I are sure to incur years from now.

Perhaps it would become part of a gift made to one of our children. Perhaps it would help pay for renting a beach house for the month of February fifteen years from now. More likely, it will help get us through another high cost month that is sure to come in my "retirement" years. Whatever the case may be, I Paid Myself $800 in August of 2018.

Paid My Wife First

I invest on behalf of my wife.

Part of being a mensch is thinking of others and besides supporting my wife and family to the best of my ability, I also consider their futures.

Yes, we are a traditional nuclear family. Neither my wife nor I have been previously married or have children by other relationships. We were married in June of 1996, our son was born twenty-five months later in July of 1998 and our daughter followed nearly five years later, in June of 2003.

So call it what you will, but I am the primary breadwinner in our family and I pay all of our bills and manage our investments. One thing that I vow to improve upon is to share the details of the accounts with my wife so she can have a better sense of how much money we have and don't have and what investments we have and how to access them should anything "happen to me."

Anyway, I mailed a check (yes, we still mail them for this account) for $500 to Vanguard for my wife's Roth IRA. Nothing fancy, just the good ol' S&P 500 fund. They moved her into the lower-cost Admiral Shares a while ago when the value of the account exceeded ten grand. I am striving to have her account hit one hundred shares next year, which would have a value of around twenty-six grand.

The five hundred that I now Pay My Wife First every month amounts to just under two shares as the price has been around $250 for a while.

Paid My Daughter First

As of now, I have saved over one hundred grand per child for their undergraduate educations. Saying "as of now" has two meanings.

First of all, I have more like fifty-seven grand left for our son, now in his third year at a private liberal arts college studying music. The topic of an upcoming post, we now pay a whopping thirty grand just for his attendance! As parents or others who pay for college already know, the tuition, room and board is not the entire cost. There are extra hundreds and thousands here and there for this and that.

|

| I pay $2,940.50 to my son's college every month. |

The second reason I say "as of now" is that I have two 529 accounts for each of my children. One is tied closely to the bond market, thus those accounts with Bright Start never really make much or lose much money.

The other accounts are tied to the stock market, thus they have both done quite well over the past few years. But having been an investor since well before 2009, I only too well realize that the $58,000 that I have in one of my daughter's accounts could very well turn into $48,000 or $38,000 over the next two years should the massive Recession that so many people predict come to fruition.

Even though it certainly marks the passage of time, which as we all know is fleeting, I am sometimes glad to be paying so much for our son's high-quality college education with the money that I have grown into a fairly substantial amount through savvy investing before it poofs into smoke.

My daughter's college savings still has plenty of time to decline rapidly should a Recession hit everyone hard in the next few years.

So I Paid My Daughter First on the first of August, just as I am doing today on the first day of September and will continue to do on the first day of every month for the foreseeable future.

|

| I have sent $400 to our daughter's 529 account on the first of every month for many years. Before that, I sent $500 per month. |

I kind of Pay My Son every month, but it comes in the form of $500 or more from our regular cash flow in addition to the $2,400 or so that I withdraw from his 529 account every month. Each monthly payment constitutes one-fortieth of paying for his bachelor of arts degree, which most of us will agree has become a necessity to make it into the middle class in this day and age.

A Ton of Bills Too

Should you think that I am so well off and successful that I can easily Pay Ourselves $1,700 First, you would be mistaken.

My family's bills and expenditures this past August most likely exceeded my income. It certainly helps that it was a three paycheck month, but that probably does not offset the massive amount of spending that we did for us. Some families can easily part with twelve grand or more in any given month. Not so much for us.

That trend is set to continue, as we purchased a vintage professional trumpet for our son in August for nearly four grand and I will be paying for it this weekend via my wife's Visa bill.

Should you read this and other posts, I do not want to give the impression that we are able to easily pay these bills, invest in our futures and maintain our suburban lifestyle of living. We probably do spend too much to "Keep Up With the Joneses," but my wife and I are determined to raise our children to become successful adults who are not saddled by a massive amount of student debt.

I just wanted to reiterate that when I often write to Pay Yourself First, it is not something that I take lightly or am just repeating from having read someone else write it. If anything, I now regret not having paid ourselves more.

|

| I'm going to pay the entire $4,651 balance on my wife's credit card this weekend. |

While it is true that our checking account is going to take a hit of over seven grand this weekend via paying off my wife's Visa, paying our mortgage automatically today and automatically contributing to our daughter's 529 account, paying our lawn mowing guy as well as several other bills to pay, I feel somewhat privileged for being able to pay these and, finally, if you have not paid yourself first lately, I urge you to do so this September.

Comments

Post a Comment