I read The Millionaire Next Door quite a few years ago soon

after it first came out.

Like Your Money or Your Life, the Rich Dad books, David

Bach’s books and the dozens of others that I have read in the Personal Finance/Self

Help genre, I loved the book, took it to heart and planned to improve my financial well-being and, thus, my family's lives.

Like every other time that I got fired up about improving upon my financial habits, emergency expenses, the high cost of

our children’s many activities, auto repairs, Disney trips, health-related

issues, pet supplies, eating out far too often and all those other ongoing

things and habits that we have in our lives took every dollar and then some.

I had also made it a priority to fund my two children’s

college accounts as much as I could and decided long ago to save a hundred

grand for each of them. I did so before

realizing that doing so would come at the expense of fully funding my own

retirement accounts, but continued to do so anyway after reading dozens of

times not to.

I know, I know...

Your

kids can join the ranks of the millions of college grads and those who were not

able to or failed to graduate who, cumulatively, owe over a trillion and a half dollars. They can make payments for ten,

twenty or even thirty years.

Well, I did not and do not want that for my children.

I’m a relatively intelligent middle aged middle class man

with a graduate degree and many years in a highly responsible professional

position. I earn just over a six figure salary but

make little else, and it took me about twenty years of low paid government

employment until I hit that mark.

My point being that I fully realize that paying for college

today is not the same as it was in the late eighties when my wife and I

enrolled in the UW. Back in the fall of

1988, in-state tuition at the UW was just under a grand per semester and for us

out-of-staters, about $2,500 or so. My

final semester of tuition ran around four grand, or about a grand more than I

pay every freakin' month including a payment tonight to my son’s college.

The hundred grand that I saved for our son will be pretty much tapped

out come spring of 2020 when he should be walking across the stage with his

name being called out to be handed a piece of paper that should help launch him

into his own middle class or above status.

As a music major, it is no guarantee, but the data is abundant that

those with college degrees tend to earn considerably more over their working

lives than those that do not (of course with many exceptions) and the political

views tend to diverge, too, with college grads tending toward the liberal side

of things more so than blue collar working class folks.

Barring an upcoming major Recession, that will certainly be a doozie and just might hit

next year or in 2020 according to many pundits, my daughter’s college accounts

have hit six the figure mark as she nears the midway of her sophomore year of high

school. Lucky me, she has even more

expensive colleges within her sights than the one my son attends.

Thus, if I had saved “only” fifty grand per kid instead of a

hundred each, I would presumably have a hundred grand more in my retirement

account than I currently do. Had I

diverted more toward paying down the mortgage on our extremely modest home,

maybe we would only owe a measly twenty-five grand on our house instead of the

one twenty-five that we do.

Each of our children would end up owing fifty grand more

than they ultimately will, but they could pay that off over the coming years,

whereas nobody will be lending us any money to help fund our retirement

years. I use the word “retirement” in

quotes for myself, as I plan to continue generating income one way or another until

I no longer can.

Anyhow, I have been reading The Next Millionaire Next Door

by Thomas Stanley and his daughter Sarah Stanley Fallaw and getting fired up

again.

I could write a hundred or more posts about things that

interest me about the book, but I’ll limit it to one thing here and one thing

there so as not to bore you to death.

One of the things that keeps popping up in my Yahoo! feed

are articles about how much savings one should have as you hit certain age

milestones.

Since my favorite and most trusted guru tends to be David

Bach (I am souring on Suze Orman and very much souring on Dave Ramsey), I often

feel a failure at hitting the savings benchmarks that he suggests.

Bach suggests having six times your salary saved by the time you hit the Big 5-Oh.

Bach suggests having six times your salary saved by the time you hit the Big 5-Oh.

In The Next Millionaire Next Door, they use a simple

formula that seems reasonable to me:

Expected Net Worth = Age x Income x .10

There is nothing squishy about age or multiplying it by .10,

or dividing it by ten if you prefer.

There should not be anything squishy about income, but I suppose that it

depends upon your definition.

When I think about my own income, I am not sure what it

is. Perhaps it is my public sector salary as published in our department's budget. But I cashed out both sick days and vacations

this year, boosting my salary by nearly four grand.

We will be collecting over seven grand next month in capital gains and dividends, each dollar (except for $60 from Annally) of which will be reinvested, and my wife makes about another seven grand at her part-time gig.

We will be collecting over seven grand next month in capital gains and dividends, each dollar (except for $60 from Annally) of which will be reinvested, and my wife makes about another seven grand at her part-time gig.

I will collect nearly two grand this year all-told with

online stuff, ads and selling stuff on eBay.

So is income my salary or is it my total compensation for

the year (including cashing out eight days), my wife’s salary, dividends and

capital gains, Amazon and eBay sales and every single dollar collected during

2018?

The difference is about fifteen grand, from about $110 K to

$125 K.

Being generous to myself (for once) and figuring that my

salary would be about $115 K at the age of the Big 5-Oh that I will turn two

Novembers from now, God willing, this book would say that I should have five

times that much as net worth.

Unless I can somehow start making an extra two to three

grand every month immediately and invest all of it and have it increase in

value, I am going to fall short. Well

short.

In all of Stanley’s books that I have read, he refers to

UAWs and PAWs.

UAWs are like me, Under Accumulators of Wealth. Dudes and dudettes who make a hundred grand at the age of

fifty who should have a minimum of half a mil in the bank, or more if you count

my wife’s salary, dividends and other forms of income.

If we combine for one twenty-five in 2020, as we

should God willing, five times that number is over six hundred grand.

PAWs are Prodigious Accumulators of Wealth.

Were I a single guy (I’m not) with no children (I have two)

or someone who does not save everything he can for their college accounts (I

do) and have their kids do every conceivable expensive suburban activity that

they want to (ours do), I most likely would have hit the mark.

I do not mind driving a shitty old minivan too much, I do

not mind our pay-as-we-go TracFones, I still watch my tube TV and we went

several years forgoing vacations in years past.

However, I am a Prodigious Accumulator of Something. It just does not happen to be wealth.

It’s books.

Yes, there is a word for my affliction which has increased,

rather than subsided, this year. On a

prior, defunct blog called The Middle Class Guy, I had set out a list of New

Year resolutions around the first of January.

|

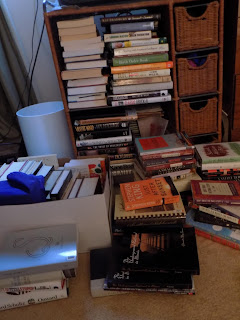

| Two of our ten or so Billy bookcases from Ikea filled with books. |

Gone into wherever pixels of expired websites go, every

resolution still resides within my brain.

As I have gained some wisdom and realized my failure at most

of my resolutions for many years, my strategy is shifting somewhat. I will be writing about it most of December,

but the gist of it is making smaller, achievable resolutions and goals and

spending more effort at improving upon habits.

But that is another post.

One of my resolutions for both 2017 and 2018 was to net

minus fifty books each of the two years.

I could write a very long post on that topic starting with how well I

was doing the first few months of 2017, easily cruising toward it and having

surpassed that goal by about April before falling off the wagon and hard.

If I were standing before God and swearing on a stack

of Torahs, I would be hard pressed to estimate the number of books that I have

net gained over the past two years. I

would likely start by guessing a hundred, but would not be too surprised if the

number is twice that.

Yes, I am a Prodigious Accumulator of Books. Whether it’s at a local library’s book sale

(I bought four today at one), Half Price Books, someone’s garage sale, a used book store, a book awards dinner, the giant shopping center in the cloud or even an occasional new book from Barnes & Noble, I buy a heck of a lot of books.

Like the simplicity of Stanley's book when it comes to being a prodigious or under accumulator of wealth, I have created my own formula for books.

|

| Piles of books in our bedroom. |

Comments

Post a Comment